1) why are accountants so important to a corporation? what function do they perform?

Many people confuse the roles of the bookkeeping department and finance department with existence the same. In reality, both departments perform separate functions.

The function of the Accounting department

- The accounting department'south focus is on the day-to-twenty-four hour period financial activities (the inflow and outflow of money) in the visitor.

- It also deals with the processing of all accounting information. It records accounts payable and receivable, fixed assets, payroll, inventory, and other bookkeeping elements.

The part of the Finance department

- The financial department'due south focus is on managing the company's avails and liabilities, with a view towards the time to come. While pocket-size businesses tend to combine the departments, corporate organizations accept separate functions and roles for both departments.

No organization can operate profitably without an bookkeeping team. Information technology is the lifeblood and center of any business or organization. To help accountants and accounting departments worldwide, nosotros've compiled a listing of the 7 essential functions that every accounting department needs to primary for seamless operations. Let'southward go started.

#1 Accounts Payable and Receivable

Accounts Payable (AP)

Accounts payable/cash disbursement refers to money that goes out from the business and is recorded as a liability in the accounting volume. The accounting section keeps records of the goods and services that your company pays for and ensures that all your business expenses get paid on time.

It also keeps track of all scheduled payments in the organization, such as inventory, payroll, and other business-related expenses. It receives invoices from vendors, records them, so processes the payment checks.

The accounting section too helps businesses identify areas to cut costs and save money. If there are opportunities to get discounts from paying vendors early on, the accounting section will point information technology out to the advisable conclusion-makers.

It is best to have different individuals in your bookkeeping department performing different roles. You can assign someone to record the accounts payable and put another person in charge of signing the checks. Businesses often use AP automation software to streamline this process.

What is AP automation software?

An AP and AR automation software helps businesses manage all invoices and transactions between a company and its suppliers/vendors. Automated AP software also integrates with other accounting software to streamline invoice management and financial reporting.

Why automate AP?

A research carried out by SoftCo , indicates that 51% of businesses found manual data entry and inefficient processes their most challenging hurting point.

Accounts Payable (AP) processes in many organizations oftentimes involve paper-intensive tasks. Newspaper-based processes and manual data entry are the almost inefficient ways to store records equally information technology leaves room for inaccuracy and inefficiency in the data.

Major challenges of a transmission AP automation system

Paper easily stacks upward, making information technology cumbersome and hard to shop. Additionally, when you need to find a item document, information technology takes a while to find it, even with the best file storage system.

AP workflow automation could help increment the efficiency and productivity of your accounting section.

What are the benefits of AP automation software?

- Eliminate transmission data entry

- Relieve time and lower costs

- Reduced accounting take chances and better collaboration

- Better insights and transparency

- Streamlined AP process

Accounts Receivable

Accounts receivable refers to money/cash or receipts that the business receives. The accounting department is in charge of tracking and bookkeeping for cash payments by customers for goods sold and services rendered.

It is as well responsible for creating and tracking invoices. The bookkeeping department besides sends friendly reminders to ensure that customers pay up their invoices when due.

Pro-tip: Businesses tin utilize for invoice financing to provide cash flow for urgent needs while waiting for customers to pay their invoice obligations.

The accounting section records accounts receivable as avails. This includes the acquirement that the business makes and the invoices that are yet to be fulfilled.

Information technology is best to assign the different accounts receivable tasks to different individuals in your accounting department. You tin put an employee in charge of recording the cash payments and put another in charge of bank deposits, for instance.

Benefits of accounts receivable automation

- Improve greenbacks position

- Relieve fourth dimension and coin

- More accurate and timely data

- Improve customer advice, client service, and satisfaction

- Reduce administrative costs

- Minimize credit risk

- Shorten the sales to payment cycle

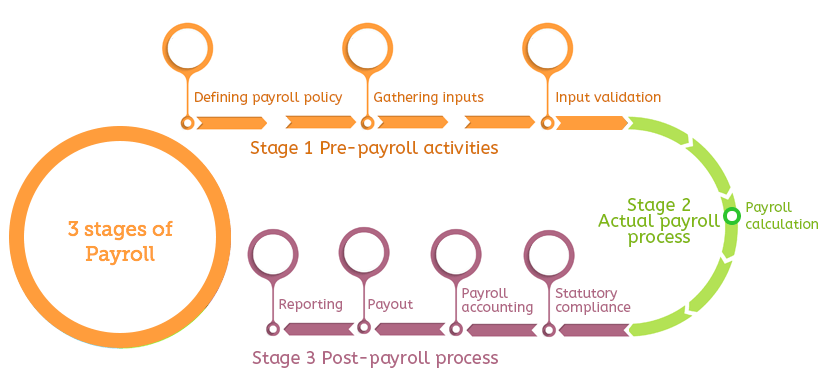

#2 Payroll and Monitoring Employee Time Offs

Payroll management is a vital role of the accounting section. They keep employee morale high by paying their earnings on time regularly.

The section needs to ensure that employees' earnings are upwards to date. It besides estimates the wages or salaries left later the advisable deductions have been made.

The part of the accounting department includes calculating employees' bonuses, benefits, and commissions accurately. It as well tracks employees' fourth dimension off, such as sick leave, PTO, vacation, and absence.

Payment of government taxes on behalf of the visitor is another function performed by the accounting department. Some of the taxes include FICA, unemployment, social security taxes, federal and country withholding, and workers' compensation.

Qualified accountants in the bookkeeping department appraise your taxes and ensure you stay compliant with the latest tax rules. Information technology besides tracks and makes tax payments to the appropriate state and federal government agencies.

Failure to make tax payments at the appropriate fourth dimension is costly and can attract a steep penalty if washed repeatedly. Taxation evasion is a crime that businesses can observe themselves committing without a functioning accounting team. The accounting department ensures that your business does not miss a tax deadline.

Additionally, payroll is a critical and circuitous bookkeeping role that every accounting department needs to master. Some organizations even outsource payroll functions to external bookkeeping agencies that specialize in payroll management.

Benefits of an automated payroll management system

A payroll management system automates your payroll processes, making it piece of cake to improve your productivity. Some of the benefits of using an automated payroll software are:

- Lower costs

- Saves time

- Quick and easy payroll reconciliation

- Regular and accurate taxation updates

- Data security

- Accurate calculations

- Increases productivity and promotes transparency

- Reduces the chance of man errors

- Simplifies the payroll process

#3 Inventory Price Management

Inventory refers to the full number of goods that a company owns in its warehouse or building. The bookkeeping department is responsible for inventory toll management. It keeps track of the system's inventory costs such as labor, raw materials, and other overhead factors.

Additionally, although the accounting department would ideally desire to lower inventory costs, it would demand to ensure information technology'southward non at the expense of the product quality. The department must also aim to find a center ground between satisfying the customer and increasing the business profit margins.

Businesses make different purchases such as raw materials for goods, types of machinery, and more throughout the year. Some are bought on credit and financed with loans. The accounting section records and tracks the business liabilities and ensures payments are processed on time. Information technology also keeps detailed records of all the cloud inventory purchases made by the company.

Benefits of inventory cost management

- Automates transmission tasks

- Reduces inventory costs

- Increased sales and profits

- Better client experience

- Increased productivity and efficiency

- Reduced risk of overselling

- Ameliorate inventory accuracy

- Avoidance of stock-outs and excess stock

#4 Cash Collections and Systematic Record Keeping

The accounting department is responsible for identifying, tracking, and recording all cash received from sales and other sources in the company. Apart from recording information technology in its database, it as well ensures that money is paid into the appropriate checking account.

Accountants ensure that there is a steady menstruation of cash in the business for its day-to-twenty-four hours operations. Additionally, they are tasked with balancing the business organisation checkbook. Large corporations assign near of the greenbacks menstruum responsibilities to the treasurer.

A key role of every accounting department is the systematic record-keeping of the visitor'due south fiscal transactions. Modern accounting departments make use of accounting software to automate their fiscal record-keeping duties. The best accounting software in the market is QuickBooks, Xero, FreshBooks, and other QuickBooks alternatives.

#5 Budgeting

Your bookkeeping department is responsible for ensuring that other departments in the company stay within the limit of the company's budget. It tracks expenses and other transactions to protect the visitor from excessive spending.

Budgeting should be based on both a cash and accrual basis. According to Investopedia, "Accrual accounting is an bookkeeping method where acquirement or expenses are recorded when a transaction occurs rather than when payment is received or made."

Budgeting based on an accrual basis makes you lose out on vital details nearly your greenbacks flows. Also, budgeting based on a greenbacks basis may not provide you accurate data nearly your performance. The solution is to combine both models for improve budgeting performances.

Benefits of effective budgeting for organizations

- Effective cash management

- Existent-time insight into spending

- Proper decision-making processes

- Proper performance evaluations

#half dozen Reporting and Financial Statements

Another role that the accounting department plays in the organization is the delivery of financial statements. The master reason why the accounting department collects financial information is to prepare authentic reports and financial statements.

Companies depend on these fiscal reports to make amend decisions, forecasts and prepare budgets. These reports prepared by accounting departments also include internal communications. Additionally, profit or loss can be determined and sustained improve with the availability of these reports and statements.

The accounting department is too responsible for producing stop-of-the-year financial statements. The company uses such reports to prospect leads, communicate with investors and other professionals contributing to business growth.

Providing financial reports and statements at regular intervals is a vital role of the accounting department. Some examples of financial reports and statements include a balance sheet , statement of activities (income statement), and cash flow statement.

#seven Legal Compliance and Financial Control

Another vital function that every accounting department needs to master is tracking and staying compliant with relevant fiscal laws.

- The accounting department is tasked with handling the tax functions in the company. They track all taxable income the visitor has to pay, set coin aside for it, and ensure timely payments to avoid tax penalties.

- Information technology keeps the company on the right side of the tax laws and tracks how taxation changes affect the business organisation. The taxes information technology files on behalf of the company include income taxes, sales taxes, property taxes, and franchise tasks.

- The department besides bears the burden of maintaining fiscal controls in the arrangement. Information technology does this via reconciliations and staying compliant with the applicable standards of accounting.

- Lastly, the bookkeeping departments also need to detect fraud and theft. Additionally, the team is likewise taxed to ensure the all-time practices are in identify to save the business from huge losses.

Construction of the Accounting Department

A typical accounting department has more than 1 employee. The functions that the accounting department performs are large, time-consuming, and labor-intensive. There is a need for every accounting department to have an organizational structure for increased productivity.

Every function the bookkeeping department performs tin exist handed over to certain individuals for ameliorate operation. Information technology is the structure of the accounting department that determines if information technology can handle its principal functions efficiently. A pre-employment bookkeeping test is an unbiased and constructive way to get insight into potential candidates' skillsets and build an accounting department with infrequent accounting skills. To streamline your hiring procedure and gauge predictive role performance, you tin can consider making pre-employment assessments a function of your custom workflows.

Investing in its construction is one of the best ways to improve your concern efficiency. The bookkeeping department is headed by the Main Financial Officeholder (CFO).

Main Financial Officer (CFO)

The CFO is the highest hierarchy officeholder in any accounting section. He or she reports direct to the Main Operating Officer (CEO) or the business organization possessor. Some of the roles the CFO plays include:

- Hiring and overseeing the activities of employees in the accounting department

- Providing financial communication for the success of the business

- Responsible for keeping the organization in compliance with government regulations

- Responsible for maintaining bookkeeping and financial activities in melody with the visitor's policies

- Oversee both accounting and financial tasks

The CFO should accept extensive experience in the bookkeeping and financial industry and have at least an accounting degree.

Fiscal Controller

The fiscal controller works with and reports directly to the CFO. They are responsible for managing fiscal bookkeeping tasks such as preparing reports, budgets, inventory, and and then on. As well, they oversee the day-to-day accounting activities and assign tasks to other employees in the department.

The controller is as well responsible for communicating the business organization financials in a linguistic communication that tin can easily be utilized to manage the business organization. They provide accurate financial reporting and analysis that helps empathize the business's financial health and performance. Additionally, statistics such equally Key Performance Indicators (KPIs), performance reviews, and other metrics are communicated through graphs, infographics, and charts.

Division Managers

In large corporations, the financial controller has three partitioning managers reporting directly to him or her. Some managers are responsible for specific functions.

- The accounts receivable manager is responsible for accounts receivable tasks.

- The accounts payable manager is responsible for accounts payable tasks.

- The payroll manager is responsible for payroll management tasks.

Each division director has a team of accountants. Smaller organizations may assign these three functions to an individual.

The Accounting Director/Chief Accountant /Auditor Supervisor

The accounting manager is responsible for maintaining and reporting financial transactions. He or she oversees the works of other accountants in the arrangement.

Some other crucial role accounting managers play is to provide checks and balances for the company by detecting theft and fraud. They ensure that employees keep to bookkeeping principles and follow the company's requirements.

An accounting director is knowledgeable about accounting requirements and GAAP rules.

Staff Accountant

Accountants that exercise not concord any position in the accounting section are called staff accountants. They are responsible for day-to-solar day accounting activities equally assigned to them past the accounting manager and other superiors.

Some of the tasks they perform include:

- Maintaining files

- Data entry

- Processing bills and payments

- Opening mails

- Creating invoices and generating receipts

- Matching checks and invoices

- Mailing checks and invoices

- Bank reconciliations

Staff accountants hold a degree or grooming in accounting. Organizations should besides organize employee training and development opportunities for accounting staff.

Interns

Interns generally assist accountants in research, data entry, and other tasks assigned to them. They often get tasks that do not require much bookkeeping experience.

Take Your Accounting Department to the Next Level with Accounting Software

Your accounting section should master and perform seven crucial functions. They include account receivable and payable, payroll, inventory management, budgeting, reports and financial statements, legal compliance and financial control, and record-keeping.

These functions business relationship for the bulk of time, labor, and resources expended by the accounting department. You can improve your accounting department's efficiency and productivity by using accounting software to automate these functions.

Accounting software helps accounting departments automate their invoices, payments, payroll, bookkeeping, and taxes. Additionally, you can utilize new historic period expense management software similar Fyle to rails all the business expenses from one key platform. The software also makes it easier and faster for accounting departments to shut their books with real-time expense reporting.

Y'all tin also use online inventory management tools to automate your accounting department inventory workload. Additionally, project tracking tools brand information technology easier for y'all to track your bookkeeping department and individual employees' activities.

Hereafter-proofing your concern, peculiarly in a post-pandemic word is very of import. Hope this article helped you understand the most important functions of the accounting section and their importance!

Source: https://www.fylehq.com/blog/accounting-department-functions

0 Response to "1) why are accountants so important to a corporation? what function do they perform?"

Post a Comment